2010s: A Decade of Beer

It’s no secret that craft beer has seen explosive growth in the last decade. Beer lovers have begun to favor quality over quantity, as well as local breweries. This combination is the perfect brew (ha! Get it?) for the craft beer revolution. In Washington alone, the number of breweries has tripled since 2010, creating over 4,300 jobs to accommodate the growth. To celebrate the closing of this decade we’ll take a look back at the past and hear from our beer managers about where we’re heading next.

How has craft beer grown in the last ten years?

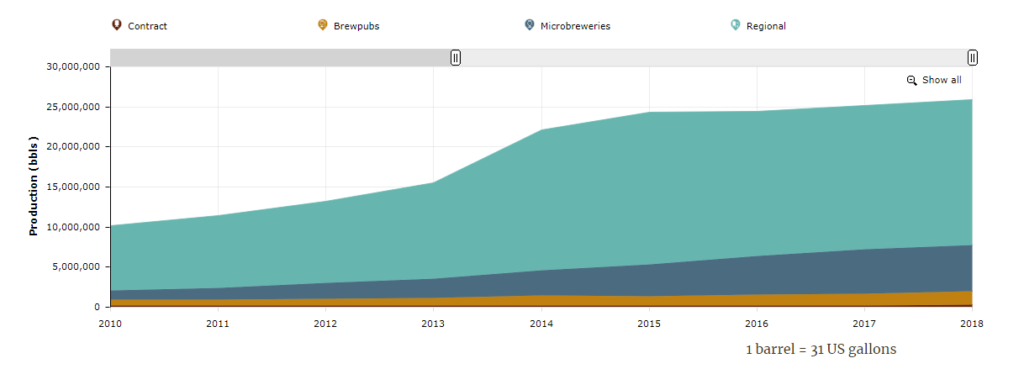

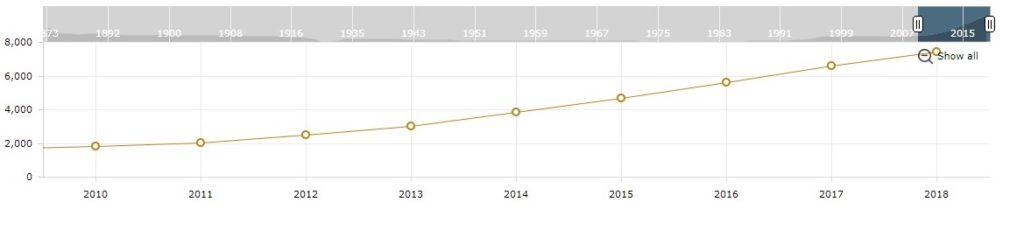

The Brewers Association compiled national brewery and production data from the last few decades. Over the last 10 years, craft breweries increased production from 10 million barrels to 26 million barrels. Additionally, 1,813 breweries existed in 2010 and the number jumped up to 7,450 by the end of 2018. This explosive growth encourages brewers to explore and expand beer categories and put the US on the map as a leader in craft beer and innovation.

Historical Craft Brewery Production by Category

Historical U.S. Brewery Count

India Pale Ales (IPA’s) currently dominate the craft market with over 1 billion dollars in sales, about 20% of the craft beer sales (according to 2017 data from Nielsen) but with over 100 beer styles recognized by the industry, it feels awfully vague to just say IPA. Our Portfolio Manager, Adam Corey, shared the insight that while the IPA category is expanding, it’s no longer about having the highest IBU or ABV but rather about the taste and flavors. Adam noted that he has seen the market shift from malty flavors, to piney flavors, currently landing on tropical flavors like pineapple and guava. His insight is confirmed by Nielsen, which reported that from 2014 to 2017 dollar sales of tangerine flavored beer jumped from $2 million to $26 million and pineapple jumped from $49,000 to $8.5 million. And of course, IPA subcategories such as hazy, juicy, and fresh are growing more popular as well. Outside of the IPA category, Saison, Gose, and Cream Ales saw a significant boost in sales over the last few years when they were practically unknown before.

Where is the future heading?

Trend One: Variety

The beer (and beverage) industry will continue to see fragmentation as the consumer demands variety and businesses struggle to distinguish themselves from the competition. Categories like Mexican imports are seeing large growth due to a growing Hispanic population and a hugely successful campaign to the younger generation as a playful lifestyle beer. CSB Vancouver’s Director of Off Prem Sales, Gary Hall, said “Mexican imports have been hot for 22 years with double-digit increases. However, I have never seen anything come out of nowhere like the Seltzer Category.”

No one had expected The Claw to suddenly appear and turn the beer world upside down. Since their debut in 2016, White Claw (owned by Mark Anthony Brands) has tripled their sales with no signs of slowing down, leaving other companies scrambling to come up with their own seltzer. At CSB, hard seltzer sales in 2016 were around 1,500 cases and by the end of this year, more than 130,000 cases will be sold.

But why? The health and fitness trend has been picking up steam since the beginning of the decade and hard seltzer is the perfect alcoholic solution: it’s low in calories, it tastes great, and it gives you the buzz without busting your waistline. Along with the increased interest in hard seltzer, the flavored malt beverage category will continue to grow.

Trend Two: Healthy Alternatives and Functional Drinks

The explosive debut of White Claw showed brewers something: consumers are ready for a change in their diet. There is no doubt that this category is here to stay, however, other beverage segments may have some struggles incorporating the trend into their brands. In the beer world, existing light beers like Miller Lite and Coors Light are making a come back because they’re already low in calories and carbs. Other brands are beginning to create their own hard seltzers, ciders, and hard kombuchas, often creating a lack of authenticity and brand identity rather than appeasing a new market.

As legalizing CBD continues to spread and people become more educated about its benefits, CBD beverages should see growth in the next decade as well. Currently, there are too many legal hurdles to go through but as the federal government becomes more involved CBD will eventually find a home.

What can brewers do to stay competitive?

As the market continues to grow and become more saturated, breweries will have to try hard to stay competitive and relevant. Here are a few tips that can guide business owners in the craft beer market in the right direction.

Tip One: Be More Engaging on Social Media

Our sales and beer managers agree that social media is going to be a huge advantage to staying competitive. The next generations to enter the 21+ market are more loyal to brands with social media engagement. They love brands that personally interact with them (while staying authentic, of course).

Tip Two: Focus on Building Your Brand

Great products are worth nothing if you don’t have the right people to sell it. Brand manager, Ryane Mooney, suggests “the ones who are having success are those who invest in people to help build the brand – brewery reps are key. They put a face to the brewery, build relationships with accounts and help get the brand name out there. Those who sit back and expect their beer to sell just because it’s there are the ones who lose relevancy quickly.” She also suggests building deep loyalty in your home market before trying to expand and branch out, which really connects to using social media as a tool to connect to the community.

Tip Three: Allocate Resources to Marketing and Advertising

According to Nielsen’s most recent Craft Beer Insight Poll, the percentage of drinkers who buy beer brands they’ve never heard of is on the decline from 37% of respondents who always or often buy unknown brands in 2015 to 21% in 2019. Brewers should take this as a sign that consumer tastes are stabilizing and they’re less likely to be “promiscuous” drinkers who keep seeking out new brands to try. By spending more money on marketing and advertising, brands can get the biggest bang for their bucks in building brand recognition.

Tip Four: While Looking Toward the Future, Don’t Forget to Glance Back at the Past

General Manager, Dean Karnofski, said it best, “everything comes to a full circle. Nobody wants to drink their parents’ beers.” While the new generation sets new trends, the older generation is still there with feelings of nostalgia and the good old days. One example is lagers making a comeback. When you see the word “lager” it’s usually associated The Big Beer (Budlight, MillerCoors, Pabst, etc.) but now the lighter style is coming back in an innovative craft fashion with an homage to traditional European styles such as Kolsch, Pilsner, and fusions like Mexican or Japanese lager.

This decade had been like a gold rush of craft beer, almost everyone who stuck their hands in the river came up with gold. But it would be irresponsible to believe and say that the good times will last forever. Newcomers will need to tread more carefully while the oldtimers will have to stand their ground to not be swept away. Regardless of what the next trend is or where the market will go, we at CSB would like to thank all our customers and suppliers for the wonderful decade of business and partnership. Next year will mark our 30th year in this business and we are excited to see what the next decade will have in store for us!

Written by Jan Fogg

Purchasing Assistant